forex profit calculator with leverage

Currency trading provides a challenging and profitable opportunity for professional investors. However, it is also a market with high risk, and traders should always monitor their positions - after all, success or failure is measured in terms of profits and losses (P&L) on their trades.

Traders should have a clear view of their profits and losses as they directly affect the margin balance on their trading accounts. If the prices are against you, your margin balance will go down, because the balance will go down and you will have less balance to trade.

Realized and Unrealized Profit and Loss

All trades you make in the forex market will be flagged in real-time. Mark-to-market account shows unrealized profits and losses on your trades. The term "Unrealized" here means that the trades you have made are open and can be closed at any time.

Market capitalization is the ratio at which you can close your trade at that moment. If you have a long position, the market marketing account is usually the best selling price. In the case of a short position, it is the price at which you can buy to close the position.

When the position is closed, profits and losses will remain unrealized. The profit or loss (realized gain and loss) is realized when the trade position is closed. In the case of profit, the balance of the margin increases, and in the case of loss, it decreases.

The total margin balance will be equal to the sum of the initial margin deposit, realized profit and loss, and unrealized gain and loss. Since unrealized profits and losses are market-specific, they remain variable, as the prices of your investments are constantly changing. As a result, the margin balance is also constantly changing.

All forex trades you make in the market will be marked in real-time. The Mark-to-market account shows the unrealized profit and loss on the trades you make. The term "Unrealized" here means that trades are still open and can be closed at any time.

Market value is the value at which you can close all of your trades. Here is the marketing account to sell with if you have a long position. In the case of a short position, it is the price at which you can buy to close the position.

Until the position is closed, profits and losses will remain suspended. The profit or loss (realized gain and loss) is realized when the trade position is closed. In the case of profit, the balance of the margin increases, and in the case of loss, it decreases.

Then the margin balance equals the sum of the initial deposit and realized and unrealized profits and losses. It is the market in which unrealized profits and losses are determined, they remain volatile, as the prices of your investments are constantly changing. As a result, the margin balance is also constantly changing.

forex how to calculate profit and Loss

The actual calculation of profit and loss on a position is clear. To calculate it all you need is the position size and the number of pips the price moves. The actual profit or loss will be equal to the position size multiplied by the pip movement.

We explain in the following example:

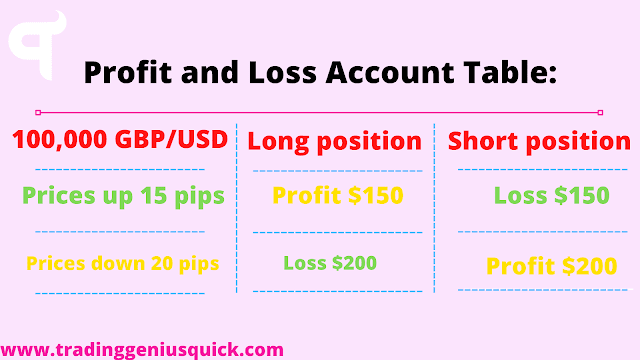

Assume that you have a 100,000 GBP/USD position currently trading at 1.3147. If the prices move from GBP/USD 1.3147 to 1.3167, then they jumped 20 pips. For a 100,000 GBP/USD position, the 15-pips movement equates to $200 (100,000 x .0020).

Profit or loss can be determined by deciding whether a trade is long or short.

Long position: If the prices go up, it will be a profit, and if the prices go down it will be a loss. In our previous example, if the position was long for the GBP/USD pair, it would be a profit of $200. Or if the price drops from 1.3147 GBP/USD to 1.3127, it will be a loss of $200 (100,000 x - 0.0020).

Short position: If the prices go up, it will be a loss, and if the prices go down, it will be a profit. In the same example, if we have a short position on the GBP/USD pair and the price increases by 20 pips, it will be a loss of $200. If the price drops by 15 pips, a profit of $150.

In the previous example, the GBP/USD rate was expressed in terms of the number of US dollars per British pound. The British pound is the base currency and the dollar is the quote currency. At 1.3147 GBP/USD, buying 1 GBP costs 1.3147 USD. Therefore, if the price changes, so will the change in the value of the dollar. Each point will equal $10, and your profit and loss will be in US dollars. As a general rule, profits and losses will be quoted in the quote currency, so if they are not in USD, you will have to convert them to USD for the margin account.

When obtaining the value of profits and losses can be used in the available balance in the trading account. Margin Account in USD.

The Bottom Line

All brokerage accounts automatically calculate profits and losses for all your trades. But understand these calculations because you will be calculating your profit, loss, and margin requirements as you structure your trade - even before you actually enter the trade.

The margin required to hold the position must be calculated. If you have a leverage of 100:1, you will need a margin of $1,000 to open a standard contract position of $100,000/CHF. This will help to understand the risks in each trade you are involved in.

To get started in forex trading, visit our article on what is forex?. For more advanced traders, visit our article on Top 7 Steps To Learn Successful Trading.

Comments

Post a Comment

Leave a motivating comment